All over the country shops are charging FIVE pence for plastic bags… but you already knew that, right? You already knew because it was almost impossible to not know when every cashier whom you handed your hard earned cash over to had a chat about it, and every newspaper you read had it sprawled across the headline. The press coverage was almost too much.

Now here is what our news flash really is about; Insurance Premium Tax (IPT) increased on the 1st November 2015, from 6%, to 9.5%! A topic which we have seen very little generic news coverage on and hasn’t really been that heavily conversed within the industry.

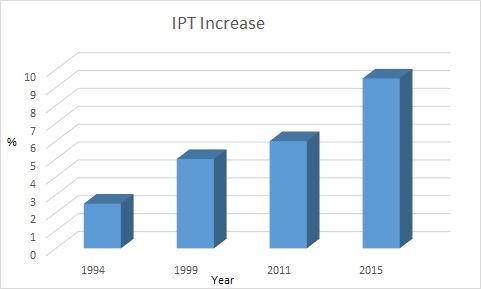

This isn’t the first time we have empathised with our customers about premium increases which have been out of our control. Having been operational since 1970, we witnessed the introduction of IPT in 1994, starting at at 2.5%, it rose to 5% in 1999, then to 6% in 2011. So by a whole 3.5%, this is the biggest increase to date. For us, each escalation came with an influx of phone calls from our clients who had noticed the difference in their premium from the year before. This graph displays the increase in IPT over the years, like any other tax it has most definitely risen, but has it gone too far this time?

So what difference will this additional 3.5% of IPT make to your insurance premium? Well, BT in their financial news have reported that it could annually increase UK household bills by £100. The keyword in that sentence is ‘household’ – what about businesses? If a consideration of a couple of cars, medical and pet insurance adds on £100, then based on UK average insurance premiums, that increases SME (small to medium sized businesses) business insurance by £408 per year and a staggering £1,650+ for larger enterprises!

Now; you might be wondering which insurance polices this affects, well the answer, unfortunately, is most of them! There are a few exemptions, such as varieties of commercial aircraft, marine policies and of course Life Insurance, although you may have heard this referred to as ‘life assurance’ this is because as we are all aware; no policy can indemnify a life. Then there is Travel insurance, IPT has been applied at the same sum as VAT (currently 20%) since August 1998, this was to assist with a premium equality between insurers and travel agents alike.

Food for Thought: If you buy three £0.05 bags a week, then that would be 156 bags a year, that’s an annual cost of £7.80. Yet the press have chosen to make this a much bigger talking point than the increase in IPT – you could even argue that not every one needs 5p bags at the supermarket but at some point nearly everyone needs insurance for legal requirement or peace of mind.

We’d love to know if you use an Insurance Broker or whether you have chosen to go direct to an Insurance Company. A common misconception is that ‘we are all the same’ however it could be true to say that an insurer will favour the needs of their underwriters (the people that rate, design & alter your policies) whereas we, the broker, have a slightly greater advantage. We can search the appropriate market of insurers putting you, our customer on a pedestal as we do so.

So we close with a note to be careful, not only in remembering your bags prior to your trip to the shops, but also with who you chose to arrange your insurance. Please don’t be afraid to question whether they really do want you to have not only the best cover, but the best price.

Thank you for reading this article, if you have any comments we would welcome the opportunity to discuss them with you and of course we are always available to provide the best of our insurance services to you and your business.